vermont income tax brackets

If youre married filing taxes jointly theres a tax rate of 335 from 0 to. Filing Quarterly Estimated Taxes.

Historical Vermont Tax Policy Information Ballotpedia

Vermont School District Codes.

. Ad Compare Your 2022 Tax Bracket vs. How Marginal Tax Brackets Work. 2019 Income Tax Withholding Instructions Tables and Charts.

TAXABLE INCOME UNDER 75000 USE THE TAX TABLES. Vermont State Personal Income Tax Rates and Thresholds in 2022. Compare your take home after tax and estimate.

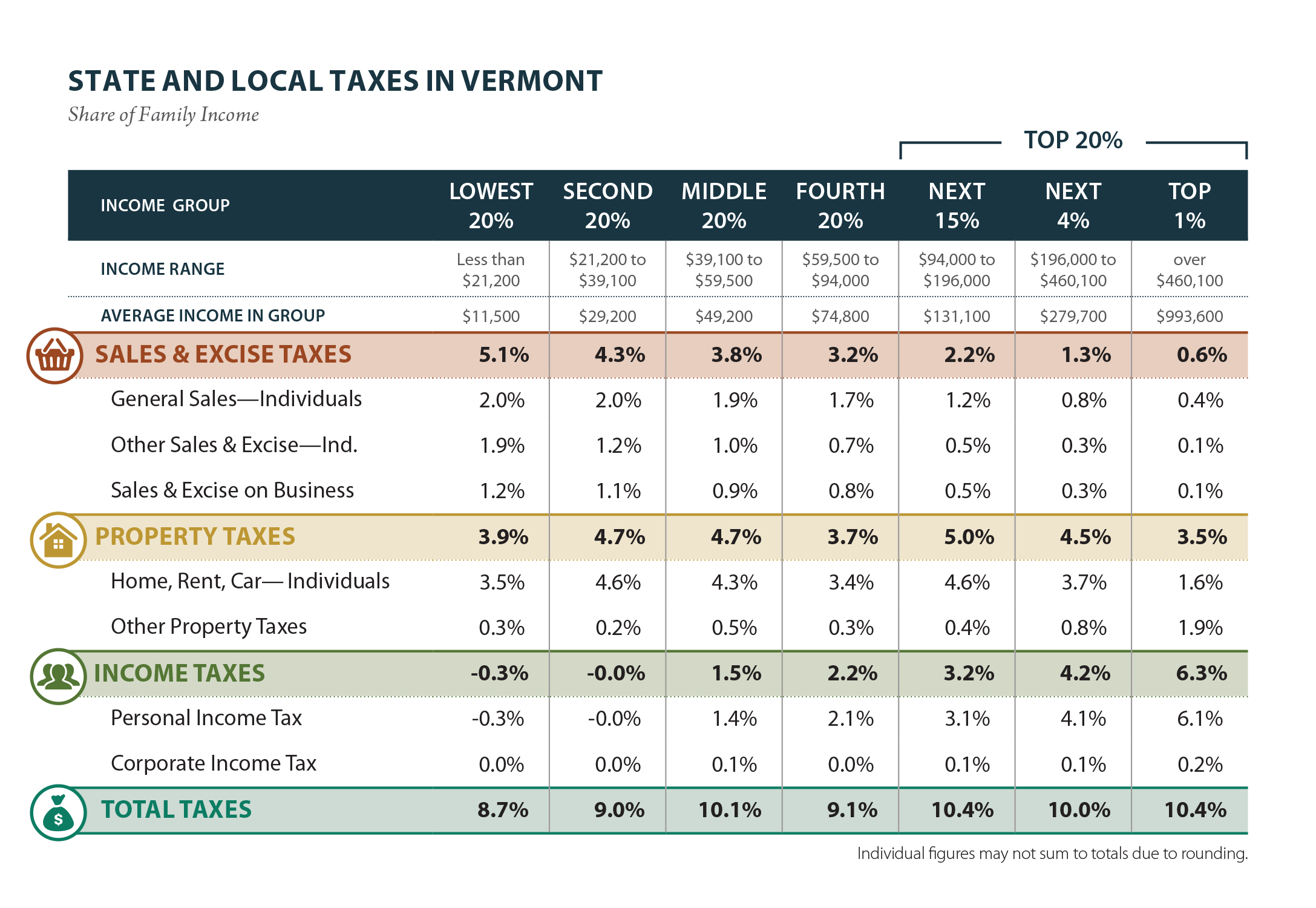

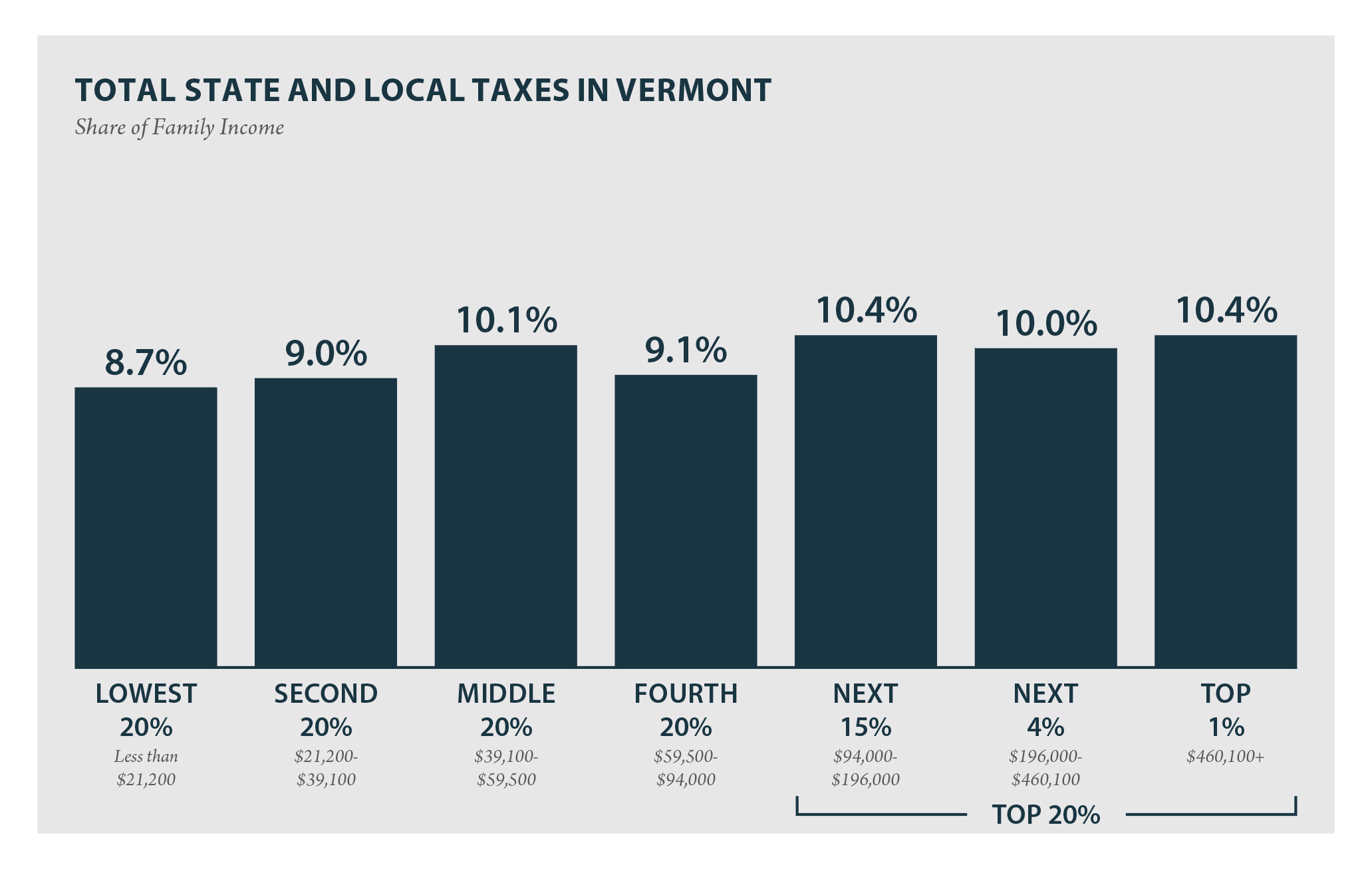

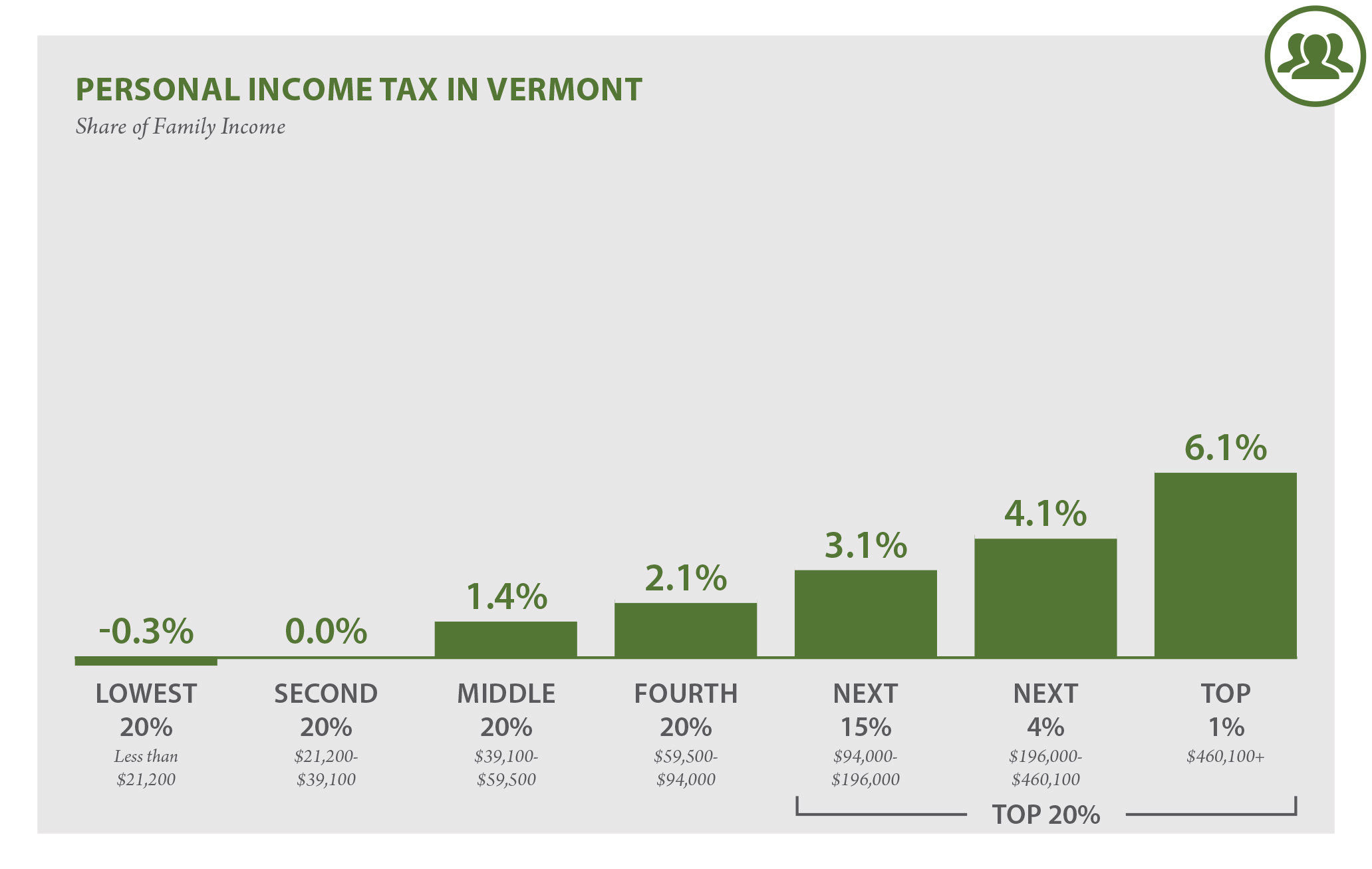

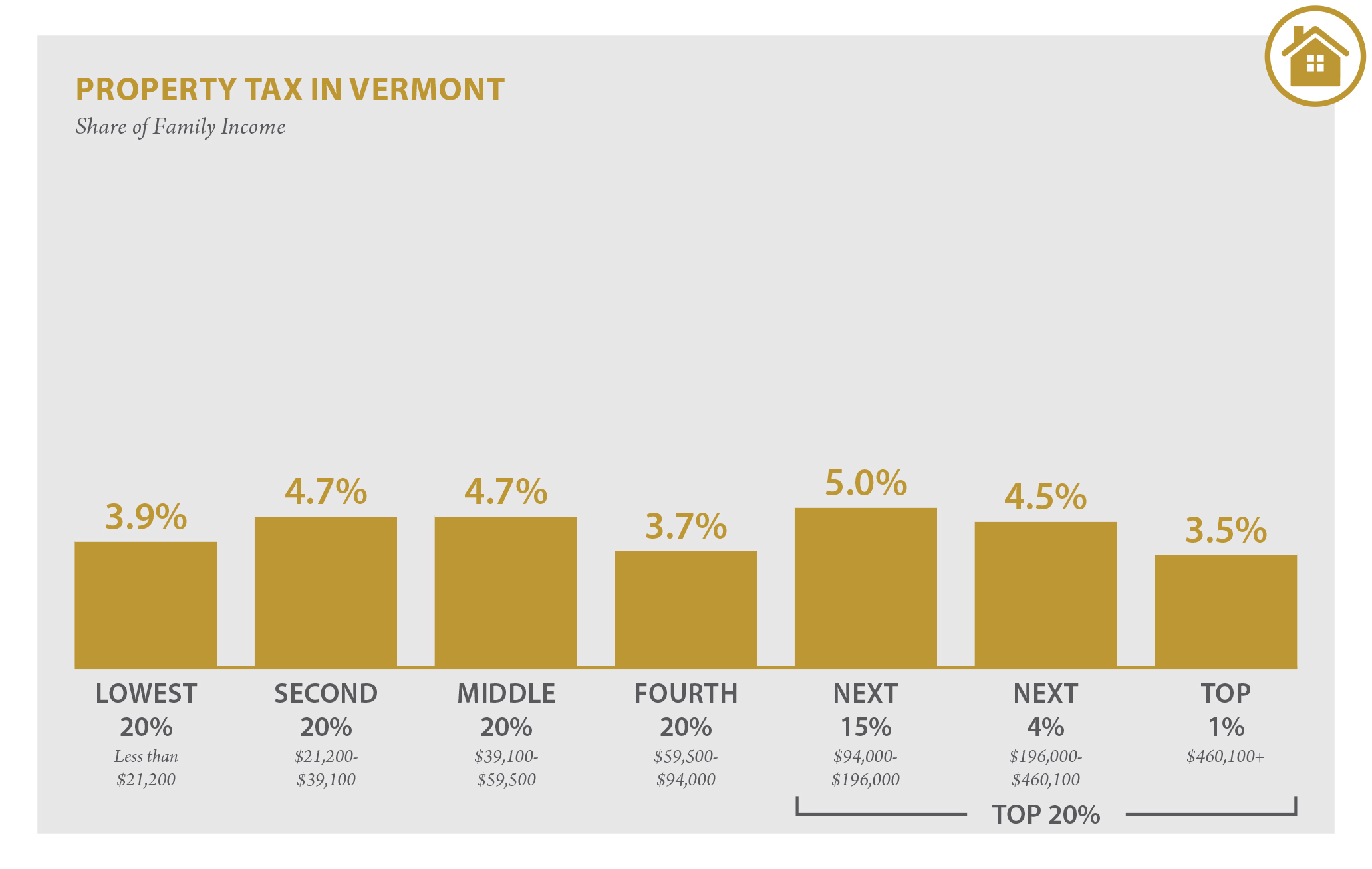

The major types of local taxes collected in Vermont include income property and sales taxes. Detailed Vermont state income tax rates and brackets are available on this page. These taxes are collected to provide essential state functions resources and programs to.

2017-2018 Income Tax Withholding Instructions Tables and Charts. 2017 VT Rate Schedules. In Vermont theres a tax rate of 335 on the first 0 to 40350 of income for single or married filing taxes separately.

Vermont has four tax brackets for the 2021 tax year which is a. Vermont School District Codes. IN-111 Vermont Income Tax Return.

IN-111 Vermont Income Tax Return. Social Security. Any income over 204000 and 248350 for.

4 rows Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and. The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. 5 rows Vermont Income Taxes.

File Now with TurboTax. Vermonts income tax brackets were last changed two years prior to 2015 for tax year 2013 and. PA-1 Special Power of Attorney.

2016 VT Rate Schedules and Tax Tables. Learn More About Income Taxes. File Now with TurboTax.

PA-1 Special Power of Attorney. W-4VT Employees Withholding Allowance Certificate. The Vermont Single filing status tax brackets are shown in the table below.

These income tax brackets and rates apply to Vermont taxable income earned January. Vermont Tax Brackets for Tax Year 2020. Tax Rate 0.

2017-2018 Income Tax Withholding Instructions Tables and Charts. E-File With Income Tax Software. 2020 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. 99200 206950 521600 760 99200 206950 - 1340500 875 206950. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

75000 99200 361900 660 75000. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax. 2017 VT Tax Tables.

5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of. As you can see your Vermont income is taxed at different rates within the given tax brackets. W-4VT Employees Withholding Allowance Certificate.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. Your 2021 Tax Bracket to See Whats Been Adjusted.

If VT Taxable But. Discover Helpful Information and Resources on Taxes From AARP.

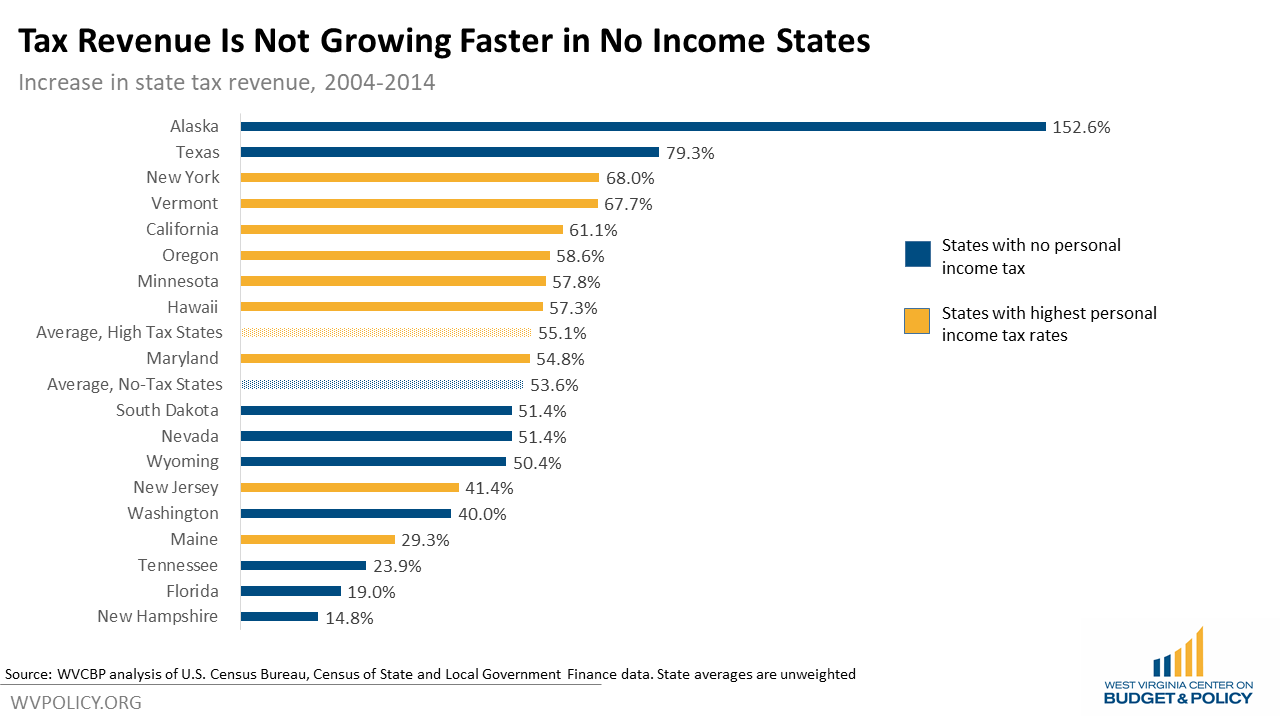

House Personal Income Tax Cut Plan Largely Benefits Wealthy Not Fiscally Sustainable West Virginia Center On Budget Policy

Vermont Income Tax Brackets 2020

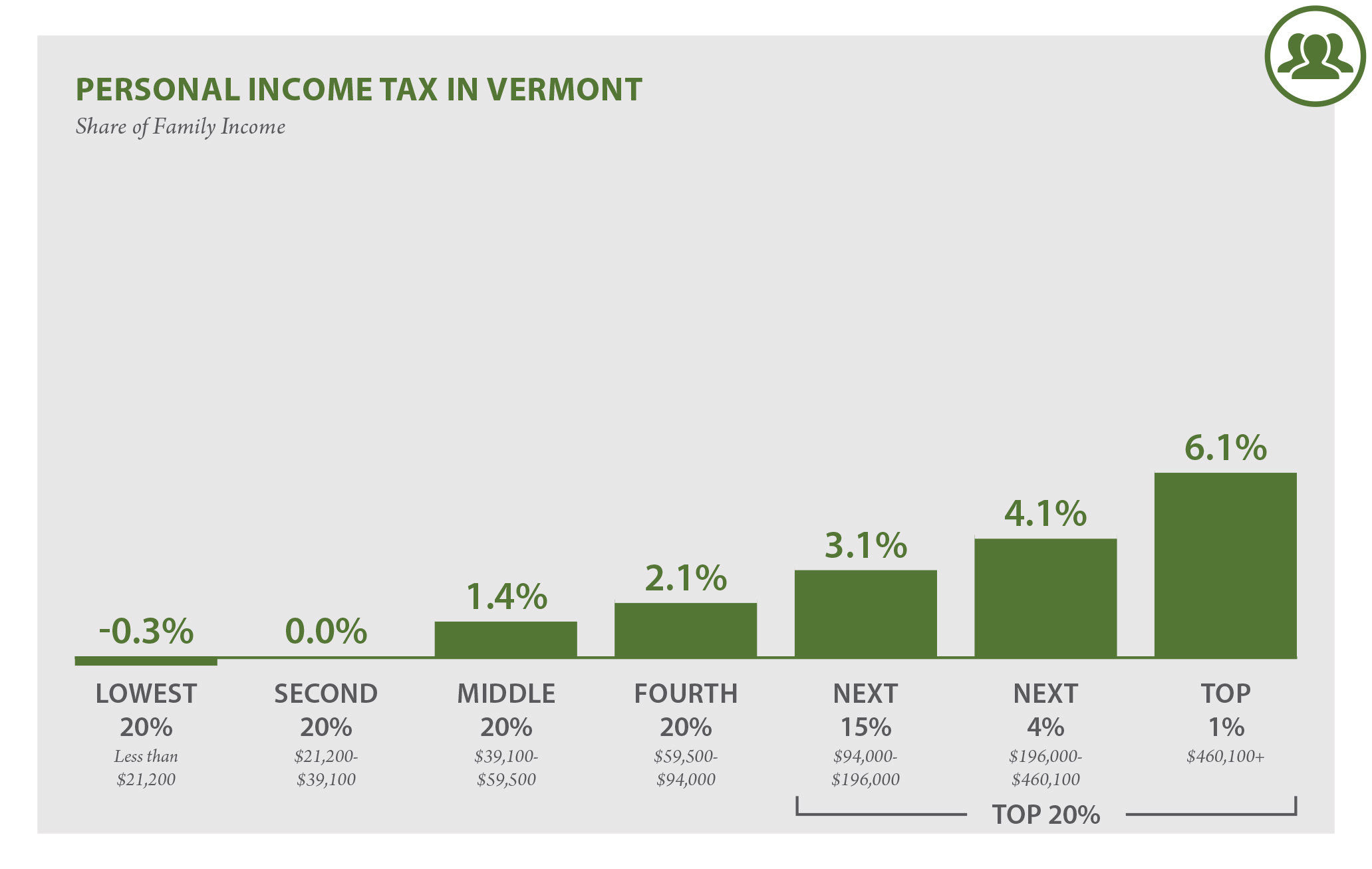

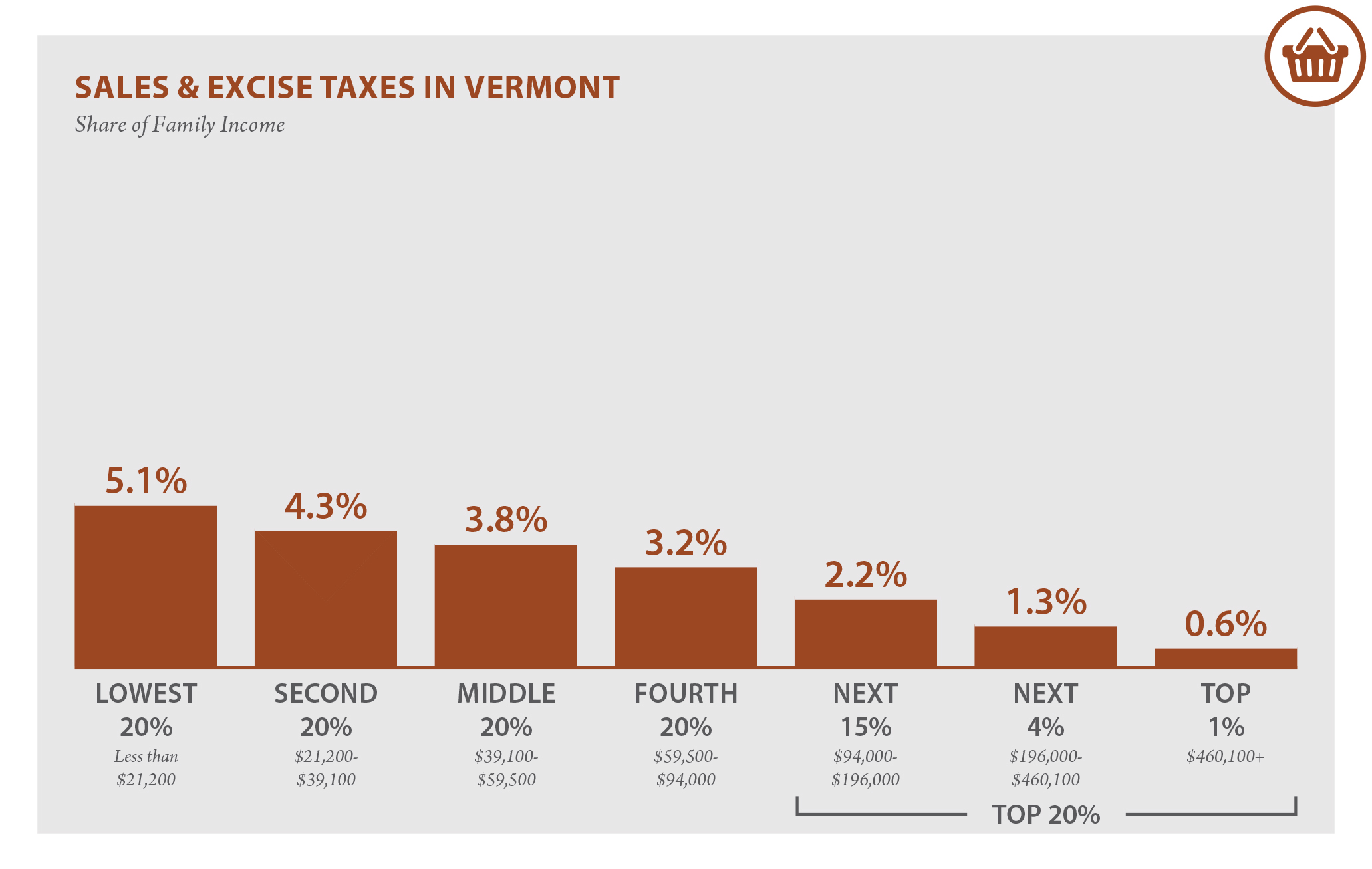

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Effective State Income Tax Map Public Assets Institute

4 27 15 The Carolina Cage Match Peter Shumlin Versus Rational Public Policy

How The House Tax Proposal Would Affect Vermont Residents Federal Taxes Itep

Vermont Who Pays 6th Edition Itep

The Most And Least Tax Friendly Us States

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Income Tax Vt State Tax Calculator Community Tax

File Top Marginal State Income Tax Rate Svg Wikipedia

Vermont S Tax System Is Still Unfair Public Assets Institute

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map